You can’t control what happens on financial markets. But you can control one factor to improve your returns.

When it comes to investing, there are things you can never control and things that you can.

You can’t control what happens on financial markets on a day-to-day basis or the market returns from your specific investments.

But you can control one of the most important things of all that ultimately affects your returns – the costs that you pay to invest.

Costs are a factor that many investors overlook.

“Investors need to understand not only the magic of compounding long-term returns, but the tyranny of compounding costs; costs that ultimately overwhelm that magic,” noted Vanguard founder John C. Bogle in his bestselling 2012 book The clash of the Cultures: Investment vs. Speculation.

In short, every dollar that you pay in costs is a dollar out of your investment return. Or, put the other way, lower investment costs mean more money will end up in your pocket over time.

How costs add up

When choosing any professionally managed investment product, it’s very important to be aware of the costs you’re being charged.

Higher costs on investment products don’t add up to better returns. It’s the opposite in fact. Over time, higher-cost products will give you lower returns because they’re taking away more cash from you.

Management fees are charged irrespective of the investment returns a product achieves and are deducted from your total investment return.

Product costs are usually referred to as the management expense ratio, or MER, and must be disclosed in a product disclosure statement and periodic statements.

A product’s MER includes management fees and other expenses such as transaction charges, account fees and other operating costs, and is normally shown as a percentage of every dollar invested.

For example, for a managed fund product with an annual MER of 0.1%, the base cost for every $10,000 invested is $10.

Compare that with a managed fund with a MER of 0.5%. The cost on the same amount invested is five times more – $50 a year.

Some investment products currently in the Australian market have MERs above 3% a year. A high percentage charge fees above 1.5% a year.

Keep in mind that your total cost of investing based on a product’s MER will compound as your investment grows over time.

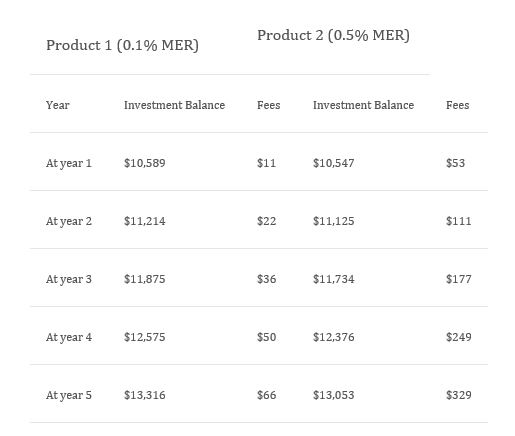

Again, using a $10,000 example and a five-year investment period, a managed fund product with a MER of 0.1% cent that achieves investment earnings of 6% a year would end up costing $66 in fees. At a 0.5% MER, your costs would be $329.

Fees increase as your investment value increases, reducing your investment balance over time.

Here’s how those calculations would look over the five years.

Source: Vanguard

See how, because of its lower fees, the investment balance on Product 1 after five years is more than $260 higher than that of Product 2.

On a 3% MER, the charges on a $10,000 investment over five years (also based on a 6% annual return) would be more than $1,800.

You should also be aware that some investment products charge performance fees on top of their standard management fees.

Products with performance fees charge them if they generate a positive return over a certain percentage level. Performance fees can be 20% of any excess profits that are made, or even higher in some cases.

Attitudes and approaches to investing

Vanguard surveyed more than 1,000 Australians aged over 18 on their attitudes and approaches to investing.

Asked whether they consider costs in their investment choices, 61% said they do each time while 29% said only sometimes. 10% said they never consider costs.

It’s Vanguard’s long held view that planning, discipline, keeping costs low and maintaining a long-term perspective are the key things that give investors their best chance for success.

While fees on investment products can’t be totally avoided, you can control which products you choose to invest in.

Do your research and, as part of that, look for comparable products that charge lower fees than others.

It’s important to compare apples with apples to ensure you’re getting the same investment coverage.

A few percentage points in costs may not seem like a lot.

But, on larger investments amounts and over longer time periods, those extra costs will really start to add up and reduce your investment returns.

Source: Vanguard November 2023

Tony Kaye, Senior Personal Finance Writer

This article has been reprinted with the permission of Vanguard Investments Australia Ltd. Copyright Smart Investing™

GENERAL ADVICE WARNING

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) (VIA) is the product issuer and operator of Vanguard Personal Investor. Vanguard Super Pty Ltd (ABN 73 643 614 386 / AFS Licence 526270) (the Trustee) is the trustee and product issuer of Vanguard Super (ABN 27 923 449 966).

The Trustee has contracted with VIA to provide some services for Vanguard Super. Any general advice is provided by VIA. The Trustee and VIA are both wholly owned subsidiaries of The Vanguard Group, Inc (collectively, “Vanguard”).

We have not taken your or your clients’ objectives, financial situation or needs into account when preparing our website content so it may not be applicable to the particular situation you are considering. You should consider your objectives, financial situation or needs, and the disclosure documents for the product before making any investment decision. Before you make any financial decision regarding the product, you should seek professional advice from a suitably qualified adviser. A copy of the Target Market Determinations (TMD) for Vanguard’s financial products can be obtained on our website free of charge, which includes a description of who the financial product is appropriate for. You should refer to the TMD of the product before making any investment decisions. You can access our Investor Directed Portfolio Service (IDPS) Guide, Product Disclosure Statements (PDS), Prospectus and TMD at vanguard.com.au and Vanguard Super SaveSmart and TMD at vanguard.com.au/super or by calling 1300 655 101. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance. This website was prepared in good faith and we accept no liability for any errors or omissions.

Important Legal Notice – Offer not to persons outside Australia

The PDS, IDPS Guide or Prospectus does not constitute an offer or invitation in any jurisdiction other than in Australia. Applications from outside Australia will not be accepted. For the avoidance of doubt, these products are not intended to be sold to US Persons as defined under Regulation S of the US federal securities laws.

© 2024 Vanguard Investments Australia Ltd. All rights reserved.